Synthetic intelligence (AI) has been the most well liked subject in tech over the previous yr and a half. It has seemingly turn into unavoidable because the expertise has been thrust into the mainstream, largely due to the business success of generative AI instruments like ChatGPT.

The commercialization of AI has been a catalyst for a lot of tech firms’ inventory costs not too long ago as effectively. Plenty of firms even remotely coping with AI have seen their inventory costs surge as buyers rushed to capitalize on the current increase. Regardless of the success of many of those firms, there appears to be much more room for progress.

Buyers seeking to get publicity to the business ought to take into account the next three firms which might be prepared for a bull run.

1. Microsoft

After years of trailing behind Apple, Microsoft (NASDAQ: MSFT) has turn into the world’s most respected public firm, with a market cap of over $3.1 trillion.

Microsoft’s AI involvement primarily comes from its strategic partnership with ChatGPT creator OpenAI. What started as an preliminary $1 billion funding in OpenAI in 2019 has turn into deeply mutually helpful.

OpenAI wants huge, scalable supercomputing capabilities to function as successfully as potential. That is the place Microsoft comes into the image. Microsoft’s cloud platform, Azure, serves as OpenAI’s principal computing infrastructure, and in return, Microsoft will get unique licenses to OpenAI’s giant language fashions (LLMs).

Gaining access to OpenAI’s LLMs has given Microsoft a leg up as a result of it is in a position to combine them into its services and increase its choices. Microsoft already has a various ecosystem of providers that many shoppers and firms depend on. Add an AI part to make them simpler and “clever,” and the potential for these providers to dominate their industries will increase.

2. CrowdStrike

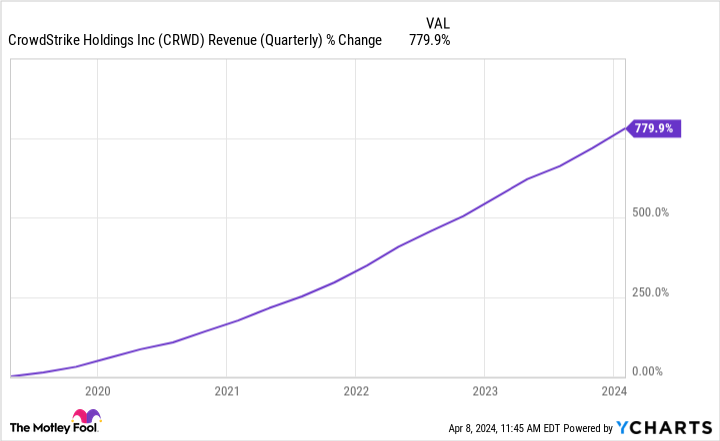

CrowdStrike (NASDAQ: CRWD) is without doubt one of the first pure AI cybersecurity firms, having used the expertise to automate cybersecurity processes for effectively over a decade.

Different firms are undoubtedly including AI capabilities to their cybersecurity platforms, however CrowdStrike has a aggressive benefit that ought to maintain robust: knowledge. For AI-based instruments to be as efficient as potential, they should be skilled on tons of knowledge, and “tons” is placing it frivolously. CrowdStrike’s head begin means it has years’ value of knowledge that may’t be matched.

Enterprise and monetary outcomes spotlight simply how efficient CrowdStrike’s platforms have been. Round 27% of its purchasers use seven or extra of its modules (merchandise in its ecosystem), and 64% use 5 or extra. CrowdStrike’s dollar-based web retention charge was additionally 119% within the fourth quarter of its fiscal 2024, which means its established prospects spent 19% extra with it, on common, than they’d within the prior-year interval.

In response to CrowdStrike and market intelligence agency IDC, the AI-native cybersecurity market is estimated to be round $100 billion this yr. By 2028, it is anticipated to hit $225 billion. This offers CrowdStrike loads of alternative to proceed asserting its market dominance and offering good long-term investor worth.

3. Taiwan Semiconductor Manufacturing Firm

As a semiconductor foundry, Taiwan Semiconductor Manufacturing Firm (NYSE: TSM) (TSMC) could not appear to be an AI inventory, however its significance to the AI ecosystem cannot be overstated.

If AI apps like ChatGPT or different LLMs are the top merchandise of a tree, the semiconductors fabricated by TSMC are the preliminary seeds. And all of it begins with knowledge and knowledge facilities. Knowledge facilities are very important as a result of they’re the one technique to retailer the huge quantity of knowledge wanted to coach AI, and these knowledge facilities rely closely on graphic processing models (GPUs), which operate because the brains for computing energy.

Earlier than you could have functioning GPUs, you want semiconductors, and TSMC is the worldwide chief in fabricating semiconductors. That is why firms like Nvidia are amongst TSMC’s largest prospects; they know different semiconductors pale compared to TSMC’s, cementing it because the go-to for different main firms.

With out TSMC’s superior processes, the AI pipeline would certainly take a success, because it’s possible that progress within the area can be slowed. That reliance alone makes TSMC one of many extra vital AI-adjacent firms. This domino impact can be anticipated to make AI-related semiconductors account for a good portion of TSMC’s income (excessive teenagers) by 2027.

TSMC is way from the one semiconductor foundry within the AI world, however it’s essentially the most crucial.

The place to speculate $1,000 proper now

When our analyst workforce has a inventory tip, it will probably pay to pay attention. In spite of everything, the e-newsletter they’ve run for twenty years, Motley Idiot Inventory Advisor, has greater than tripled the market.*

They simply revealed what they consider are the 10 greatest shares for buyers to purchase proper now… and Microsoft made the checklist — however there are 9 different shares chances are you’ll be overlooking.

*Inventory Advisor returns as of April 8, 2024

Stefon Walters has positions in Apple and Microsoft. The Motley Idiot has positions in and recommends Apple, CrowdStrike, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

3 Prime AI Shares Prepared for a Bull Run was initially printed by The Motley Idiot