Volatility is a given when placing your cash to work on Wall Road. Though the foremost inventory indexes have prolonged monitor information of accelerating in worth over the long term, we have navigated two bear markets since this decade started.

When the going will get powerful on Wall Road, traders — together with members of Congress — have typically turned their consideration to time-tested, industry-leading companies that supply a wealthy historical past of outperformance. Whereas the “FAANG shares” are an ideal instance of what I am speaking about, it is firms enacting inventory splits that traders (and lawmakers) have gravitated to.

Traders (together with lawmakers) are flocking to stock-split shares for a superb cause

A “inventory cut up” is an occasion that permits a publicly traded firm to change its share worth and excellent share depend by the identical magnitude, all with none affect to its market cap or working efficiency. It is a purely beauty maneuver that may make an organization’s shares extra nominally reasonably priced to on a regular basis traders, as with a forward-stock cut up, or can improve an organization’s share worth to make sure continued itemizing on a serious inventory change, as could be seen with a reverse-stock cut up.

For all intents and functions, most traders are likely to hone in on firms enacting ahead splits. Whereas there are choose situations the place firms enacting reverse splits have gone on to be phenomenal investments (maybe none extra so than on-line journey reserving web site Reserving Holdings), firms enacting forward-stock splits are sometimes firing on all cylinders from an working standpoint.

For the reason that midpoint of 2021, virtually one dozen high-profile firms have accomplished or introduced a ahead cut up. Among the most-prominent of those firms contains e-commerce behemoth Amazon (NASDAQ: AMZN), web search large Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG), and North American electric-vehicle (EV) kingpin Tesla (NASDAQ: TSLA). Amazon and Alphabet enacted 20-for-1 respective inventory splits, whereas Tesla accomplished a 3-for-1 ahead cut up.

What these firms share is well identifiable aggressive benefits which have helped them outperform over lengthy durations.

Amazon accounted for practically 38% of estimated on-line retail gross sales within the U.S. in 2023. However extra importantly, it is the mother or father of Amazon Internet Providers (AWS), the main international cloud infrastructure service platform. Regardless that AWS accounted for “solely” a sixth of Amazon’s internet gross sales final yr, it generated two-thirds of the corporate’s working revenue.

Alphabet’s Google devoured up a powerful 91% of worldwide web search share in March, and hasn’t gone a month with out securing at the least a 90% share of worldwide web search in 9 years. It is also the mother or father of YouTube, the second most-visited social web site on the planet.

Tesla is the primary automaker to have efficiently constructed itself from the bottom as much as mass manufacturing in nicely over a half-century. It produced virtually 1.85 million EVs final yr and is the one pure-play EV maker that is producing a recurring revenue.

In different phrases, it is not exhausting to see why on a regular basis traders and lawmakers alike have flocked to stock-split shares.

Congress’ most lively inventory dealer is shopping for shares of this magnificent stock-split inventory

Because of the STOCK Act, which requires lawmakers to report their buying and selling exercise of $1,000 or extra inside 45 days, retail traders can maintain tabs on what our elected officers are shopping for and promoting. Primarily based on periodic transaction studies, we have discovered that Congress’ most lively dealer, Home Rep. Ro Khanna (D-Calif.), has been shopping for shares of the most-prominent stock-split inventory of 2024: retail large Walmart (NYSE: WMT).

Khanna is a busy consultant from a inventory buying and selling standpoint. In 2023, he made 4,253 trades, based mostly on information from Capitol Trades. For context, that is over twice as many trades because the second most lively inventory dealer in Washington, D.C., Rep. Michael McCaul (R-Texas), who accomplished 1,826 trades final yr.

Based on filings, Khanna acquired between $50,000 and $100,000 price of Walmart widespread inventory on Oct. 31, 2023, one other $15,000 to $50,000 in shares on Jan. 10, 2024, and between $15,000 and $50,000 in shares on Feb. 13, 2024.

What’s significantly noteworthy about Khanna’s last buy is it got here after Walmart had introduced its plans to conduct a 3-for-1 ahead cut up.

Doug McMillon, the president and CEO of Walmart, famous in his firm’s press launch saying the cut up that:

Sam Walton believed it was necessary to maintain our share worth in a variety the place buying entire shares, fairly than fractions, was accessible to all of our associates. Given our progress and our plans for the long run, we felt it was a superb time to separate the inventory and encourage our associates to take part within the years to come back.

Walmart accomplished its 3-for-1 cut up prior to start out of buying and selling on February 26.

Inventory-split inventory Walmart gives clear aggressive benefits, however its shares at the moment are expensive

Except for producing loads of buzz from its inventory cut up, Walmart has traditionally used its measurement as its largest aggressive edge.

Though measurement would not all the time matter within the enterprise world, having deep pockets can are available in significantly helpful for retailers. With the ability to purchase merchandise in massive portions helps Walmart cut back its per-unit prices and, in the end, lowers the gross sales worth of these objects. The corporate’s draw with customers has lengthy been its skill to undercut conventional grocery shops and native mom-and-pop retailers on worth.

Walmart’s shops aren’t tiny, both. The corporate purchases groceries and merchandise for the house that attract all sorts of customers. Its expansive product choices drive residence the concept it may be a one-stop purchasing vacation spot for customers.

Walmart can also be benefiting from its aggressive investments in know-how. This contains the whole lot from enhancing the net ordering course of for its clients to smoothing out the kinks in its provide chain to make sure that its shops have the fitting merchandise.

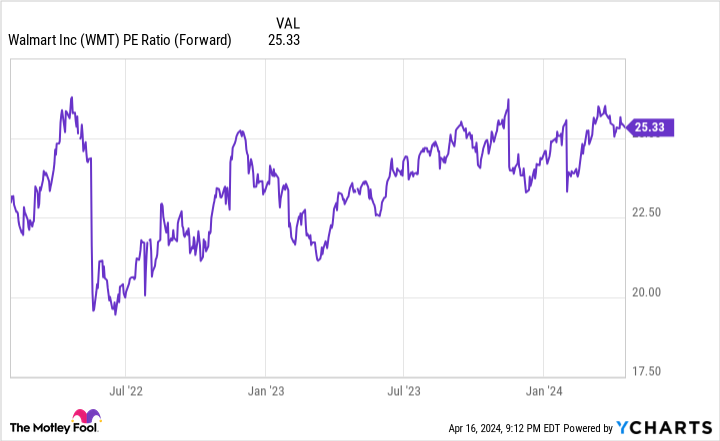

Over the long term, Walmart has confirmed it is a phenomenal enterprise. However as issues stand proper now, Walmart’s inventory is, arguably, expensive.

Though stock-split shares sometimes command a valuation premium due to their simple aggressive benefits, a ahead price-to-earnings ratio of 25 could be the higher certain for an organization not outpacing the speed of inflation by a lot within the progress division.

For instance, excluding foreign money actions, Walmart registered gross sales progress of 4.9% in fiscal 2024 (ended Jan. 31, 2024). Wall Road analysts are forecasting gross sales progress of roughly 4% in fiscal 2025 and financial 2026. All three of those figures aren’t a lot greater than the prevailing charge of inflation within the U.S. In different phrases, there’s not a lot in the way in which of true natural progress from Walmart, even with its e-commerce gross sales booming.

Whereas affected person traders in Walmart ought to just do high quality, lively merchants, like Home Rep. Ro Khanna, might find yourself dissatisfied.

Do you have to make investments $1,000 in Walmart proper now?

Before you purchase inventory in Walmart, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Walmart wasn’t considered one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $535,597!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of April 15, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Sean Williams has positions in Alphabet and Amazon. The Motley Idiot has positions in and recommends Alphabet, Amazon, Reserving Holdings, Tesla, and Walmart. The Motley Idiot has a disclosure coverage.

The Most Lively Inventory Dealer in Congress Is Shopping for Shares of This Magnificent Inventory-Cut up Inventory was initially revealed by The Motley Idiot